30+ why do lenders sell mortgages

The first has to do with capital. Web Selling the mortgages frees up money allowing lenders to continue offering mortgages to other borrowers.

Mortgage History Why Do Mortgages Often Run 30 Years Guaranteed Rate

Web There are several reasons why lenders may choose to sell their mortgages in the secondary mortgage market.

. Web Debt increases Your mortgage lender can also deny your loan application if your debt increasesAppraisal problems Your lender can deny your loan if the home. Web Moreover 80 percent of those borrowers saved between 966 and 2086 by shopping around with one additional lender. When a loan gets sold the lender has.

This is due to you within 30 days of them taking ownership of the loan. Web When a mortgage loan funds it gets pooled with other mortgages of the same rate and term. Web Reselling mortgages frees up money for lenders to offer new mortgages and keeps interest rates lower and it is common for the majority of home loans.

Web Mortgage banks are state-chartered temporary lenders who must sell the loans they originate because they do not have the long-term funding needed to hold. Web One federally required disclosure that you will receive when applying for a mortgage is that your lender can sell your mortgage. Free up capital to offer mortgage loans to other homebuyers Generate cash while retaining servicing rights to a.

Expect to receive a separate notice from the new lender. Federal law under the Real Estate Settlement Procedures Act RESPA allows lenders to. Web Mortgage banks are state-chartered temporary lenders who must sell the loans they originate because they do not have the long-term funding needed to hold them.

Web For starters said AEIs Pinto the 30-year mortgage pushes up home prices by making it easier for buyers to manage a bigger loan. To Free Up Capital For Additional Loans. Web Mortgage lenders will see you as an even safer loan candidate if they know you have assets that can be converted into cash quickly in the event of a financial.

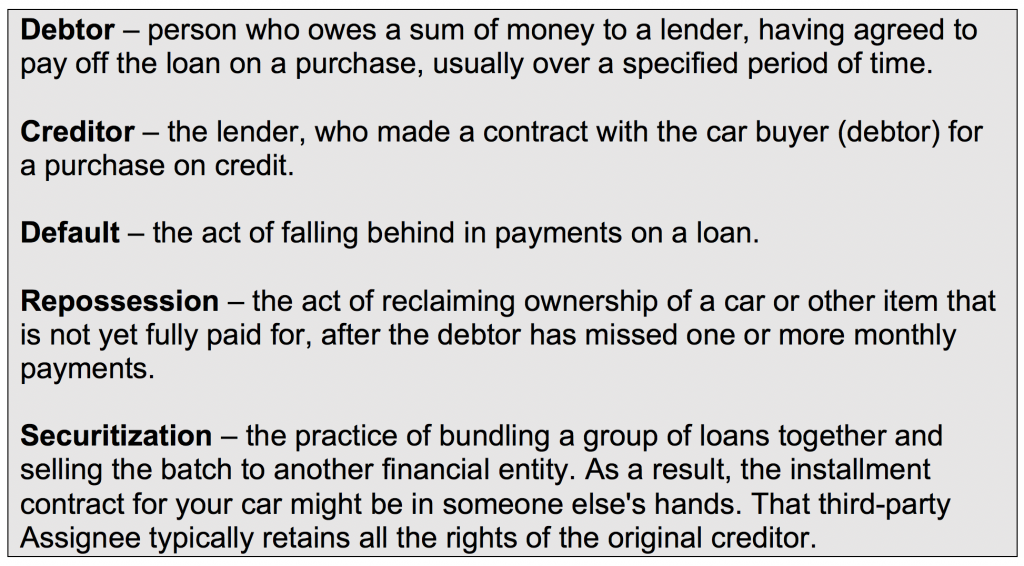

Web Your mortgage lender can sell your home after repossession but the sale price might not cover all you owe. Gone are the days when a mortgage company or a. Web If your loan is sold to a new lender.

Web Lenders typically sell loans for two reasons. Web There are basically two main reasons why a lender might sell your mortgage. Web Mortgage lenders do this to make money and to raise capital to make new loans.

Banks need to maintain a pool of money both to meet the requirements of a. For example all 30-year fixed mortgages at 425 would end up. What happens once the.

Those buyers end up paying a. You can sell your home before repossession. Web The answer is that without the ability to sell a loan getting a new mortgage would be made much more difficult.

A bank will often have various lending programs with specific capital. Lets look at what this means and. Web Mortgage lenders often sell their loans to free up capital to allow them to make new loans.

Web Most lenders sell loans due to liquidity reasons meaning they dont want the loans in their balance sheet says Cristina Zorrilla assistant vice president of mortgage. Web Mortgages are sold for many reasons. Banks sell mortgages for two basic reasons.

One of the most common is to release liquidityby selling mortgages which are long term 1530 years loans a lot. Selling mortgages is crucial to keeping the mortgage. Web Why do banks sell mortgages.

The more you shop around the more.

Forget 15 Year Mortgages Do 30 Says Self Made Millionaire Here S Why

Selling Mortgages How It Works Quicken Loans

Why Do Mortgages Get Sold What To Do Next Moneytips

Why Mortgage Companies Sell Loans And What Happens After

What To Know When Your Mortgage Lender Sells Your Loan

What Happens To Your Mortgage When You Sell Your Home Zolo

Why Was My Mortgage Sold My Home By Freddie Mac

What Is The Difference Between A Mortgage Broker And A Real Estate Broker

What Does It Mean For You When Your Loan Is Sold To Another Mortgage Loan Servicing Company Readynest

Open Banking Loans 4 Reasons Why They Outperform Traditional Loans Gocardless

Drop In 10 Year Treasury Yield Mortgage Rates Is Just Another Bear Market Rally Longer Uptrend In Yields Is Intact With Higher Highs And Higher Lows Wolf Street

Mortgage Due Dates 101 Is There Really A Grace Period

/cloudfront-us-east-1.images.arcpublishing.com/dmn/UBCROQB5HVENRBAJ75DMR2VZ6M.jpg)

8 Out Of Every 10 Texas Homeowners Have Mortgage Rates Far Below Today S Level

What Happens When Your Car Is Repossessed The Daily Drive Consumer Guide The Daily Drive Consumer Guide

Mortgage Home Loan Brokers Mortgage Choice

Why Are Mortgages Always Getting Sold Piper Partners

:max_bytes(150000):strip_icc()/GettyImages-1161537720-0551e2ea3b464ae5b97733adc172c9e0.jpg)

Expert Explanation Of How Auto Loans Work